Fannie Mae Updates – 620 Credit Score Eligibility in DU

Coming with the next DU update the week of September 18th, DU will be modifying their risk assessment, GMFS will adopt Fannie Mae guidelines and updates as released on August 11, 2021. To read the complete Release Notes click here.

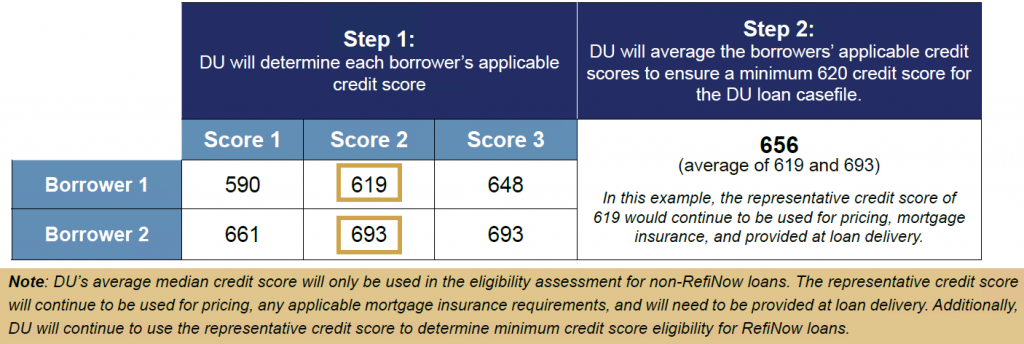

DU currently uses credit scores to ensure compliance with the 620 minimum representative credit score requirement. To support homeownership opportunities for more underserved borrowers, we are updating the credit score used by DU in the eligibility assessment. For loan casefiles with more than one borrower, DU will now use an average median credit score as follows when determining if a loan casefile meets the minimum credit score requirement of 620:

- First, DU will determine each borrower’s applicable credit score (middle of the three scores received, or the lower of the two when only two scores received).

- Second, DU will average the applicable credit scores for all of the borrowers on the loan casefile to determine if the 620 credit score requirement is met.

Note: This method will not result in a credit score lower than the representative credit score. The average median credit score will either be:

- the same as the representative credit score for loans with one borrower, or

- the same or higher than the representative credit score for loans with multiple borrowers.

The following is an example of how the average median credit score will be calculated.

Other notable changes and updates, for details, please see Lender Letter LL-2021-03

Age of documentation Aug. 11

Effective: These policies became effective for loans with application dates on or after Apr. 14, 2020 and are no longer applicable as of Aug. 11, 2021.

Market-based assets Aug. 11

Effective: These policies became effective for loans with application dates on or after Apr. 14, 2020 and are no longer applicable as of Aug. 11, 2021.