Update – Fannie/Freddie Announce Refinance Price Adjustment Postponed, GMFS Reviewing Locks

New Adverse Market Refinance Pricing Fee Postponed!

The Federal Housing Agency has directed Fannie Mae and Freddie Mac to postpone the previously announced loan-level price adjustment of 50 bps for new refinance transactions.

The new refinance price adjustment will NO LONGER be assessed on new locks and re locks.

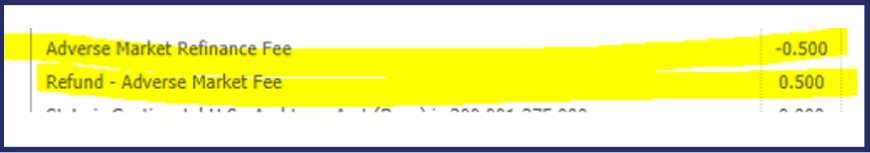

The lock desk is doing a full evaluation of recently locked loans. If your loan was locked between 8/14/2020 and 8/25/2020 and was charged the FHFA adverse market fee your lock will be updated to offset the fee (see below).

After the lock desk has completed our update you will see a new lock in TPO Connect. At that time, you have the option of submitting a change request to either lower your rate or however you choose to use those funds.

Please give us until Monday, August 31st to work through the pipeline. Once the loan has been reviewed and corrected, your District Director will contact you.